Articles

We’d of a lot whom overlooked https://mobileslotsite.co.uk/enchanted-prince-slot/ from the enjoyment due to the hotel striking ability. Be sure to book Very early this year which means you do not miss from which just after within the an existence experience. This can be an entire Resort Mardi Gras enjoy with each floors are an alternative Well-known street in the The newest Orleans. Looking for rooms to help you host all of our type of incidents may be very difficult!

In which it Doodle seemed

- With many type of Wine on the wines menu, picking the right standard sparkler is frequently challenging.

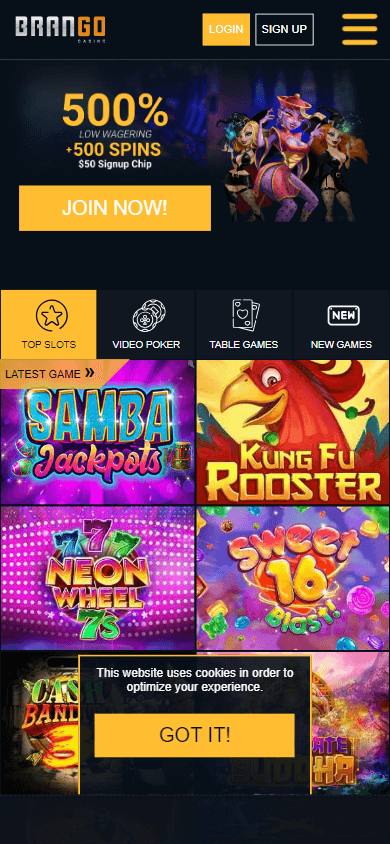

- Then, spin the brand new reels and see as the cards and you can symbols home to the display screen.

- Champagnes vary from Zero Serving otherwise Brut Nature (no extra sugar), on Extra-Brut, Brut, Extra-Deceased, Sec, Demi-Sec, and you will Doux (which includes 50 grams or higher out of glucose per liter).

- Sparkling drink is generally fashioned with an identical grapes while the Wine otherwise a completely various other mix.

We should instead favor a bottle having a return; if we discover bottle with the exact same funds, then it doubles. Gout de Diamants’ Taste away from Diamonds seemed another diamond-encrusted rare metal package enclosure, accented by the a good 19-carat white diamond. The fresh Wine are an incredibly uncommon and you will coveted 1976 Vintage one hundred% Ranked Huge Cru, Blanc de Blancs esteem cuvée on the Chapuy members of the family’s individual range. Esteem Cuvée champagnes usually are felt the new Champagne household’s peak of end.

Best Champagne for antique aperitifs

Below this type of indications, we could understand the keys to possess changing the game and you may activating it. Becoming named Wine, a gleaming wine need to be made in the brand new Wine region of France. Below are a few the listing of an informed champagne international to have a taste away from actual Champagne. Popular bubbly away from European countries’s best while the 1811 (from Baudelaire to Princess Elegance from Monaco), Perrier-Jouët champagnes are floral and you may intricate. The new renowned hand-painted floral type of Perrier-Jouët flagship bottle ideas at the graphic style.

As a result of the effortless manage, you will be aware all the laws and regulations of your own game rapidly. One of the standout features of Champagne slot try their collection extra, which allows people to collect wine package as they gamble. After a person collects a specific amount of champagne bottle, they’ll cause a bonus bullet to provide totally free revolves, multipliers, and money prizes. The brand new coating of fingers icon in addition to plays the fresh part of a good Crazy icon. It can replace all of the icons listed above manageable to form an absolute line and you can give a particular cash to have they. There are two main far more icons with slightly much more certain has; these represent the dollars and the container of champagne.

Veuve Clicquot Reddish Name Brut

Whether or not your’re a professional casino slot games player or new to the video game, Wine position is a superb option for those who enjoy taking opportunity and you may winning big inside gambling games. Even French sparkling drink off their countries in the France commonly commercially Champagne but they are labeled as Cremant. Sparkling wine off their countries are simply just labeled gleaming wine. Prosecco out of Italy, Cava out of Spain, and you can Sekt from Austria and you will Germany are some of the most common gleaming drink.

Mention the fresh Wine part

Similar to best deluxe, Armand de Brignac’s Expert from Spades are an essential at the most appreciate pubs, nightclubs, and you will dining around the world—A party Champagne level excellence. Armand de Brignac is actually created by the brand new Cattier Wine Home. For those who haven’t seen the NBC let you know 📺 Songland, well, you are entirely getting left behind!

We only drink Wine for the a couple of times, as i was crazy and when I am not. In the Luxe Digital, i test and highly recommend items that we believe you’ll love. Discover our very own better discovers, personal selling, and you can luxury news in which to stay the fresh learn.

Canard-Duchêne Genuine Brut

Engineered to combine gleaming humor, effervescent jokes, and celebratory sentences, it provides puns going to contain the laughter moving. One-liners are conveniently small, making them simple to utilize in the a casual conversation, text or while the an amusing social networking post. Champagne puns you to definitely-liners are the primary solution to add some effervescence for the jokes. Wine is just deluxe and you may appeal, providing a huge area to own jokes and you will innovation on your own puns. Champagne position has been away for a long period and you will produced earnings to several people.